Update on Just Cause Termination

A recent case at the Ontario Labour Relations Board (OLRB), Giggly Panda Baby Spa

Inc. v. Breanne Norris (Giggly), has again highlighted the difference between the

Ontario Employment Standards Act, 2000 (ESA) standard for termination without

notice and the common law “just cause” standard.

In Giggly, the employee was asked to work July 1st, a statutory holiday. She

only agreed to work if she received “double time”. Further communications took

place, and the employer eventually terminated the employee. The employer claimed

that the employee blackmailed and extorted it by asking for more pay and terminated her

for just cause.

The OLRB confirmed that the correct analysis for determining whether the conduct

amounts to “wilful misconduct, disobedience or wilful neglect of duty” (which is the

language used in the ESA) is whether the employee “consciously and deliberately

engaged in some positive act of misconduct or deliberately refrained from

performing duties or responsibilities that he or she was required to perform.” As

the employee was not obliged at law to work on the statutory holiday, the requests for

“double time” were not wilful misconduct, disobedience or neglect of duty. The

requests for more compensation were simple negotiations, as opposed to extortion or

blackmail.

The Giggly case follows the 2022 Ontario Court of Appeal decision in Render v.

Thyssenkrupp Elevator (Canada) Ltd., in which the Court found the employer liable for

notice pay under the ESA even though it agreed there was just cause for dismissal at

common law. Because the ESA test is more stringent than the common law test, an

employee fired for just cause may still be entitled to notice and severance pay under

the ESA.

Takeaway: Employers should be mindful of the difference between the wilful misconduct

standard under the ESA and the common law just cause standard when considering

terminating an employee without notice or pay in lieu. An employee may be entitled to

ESA notice/severance pay even if the employee’s conduct amounts to just cause at

common law.

Upcoming Changes to the Canada Labour Code

As of December 15, 2023, the Canada Labour Code (which applies only to federally-regulated

employers) will require employers to provide free menstrual products

(including tampons and menstrual pads) in all washrooms in the workplace, regardless of

whether the washroom is assigned to one particular gender. Covered disposal containers

for the products will also be required at every toilet in the workplace.

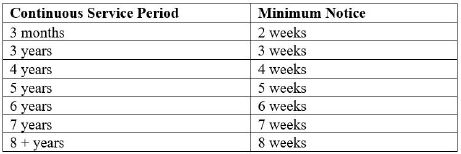

As of February 1, 2024, the minimum notice requirement under the Canada Labour

Code will increase for individuals who are terminated without just cause and who have

at least three years of continuous service. To satisfy the requirement, the employer can

choose to provide notice, pay in lieu of notice, or a combination of the two. The new

notice periods are set to increase as follows:

In addition, as of February 1, 2024, upon the termination of an employee, employers

will have to provide the employee with a written statement of benefits that includes the

employee’s vacation benefits, wages, severance pay and any other benefits and pay

arising from their employment. This statement must be provided no later than on the

effective date of termination when an employee is terminated with pay in lieu of notice.

If an employee is provided with working notice, the statement must be provided no later

than two weeks prior to the effective date of termination.

2023 AODA Compliance Report Deadline

Under the Accessibility for Ontarians with Disabilities Act (“AODA”), businesses and

not-for-profit organizations with 20 or more employees in Ontario, as well as designated

public sector organizations, have until December 31, 2023, to file their latest

Accessibility Compliance Report. The form is a self-reporting tool to advise the

Ministry for Seniors and Accessibility whether an organization is compliant with the

AODA and the Integrated Accessibility Standards Regulation (“IASR”). The form for

the Report is available online. Monetary fines may be imposed under the IASR if an

organization fails to meet its reporting obligations.

Please click here to obtain a copy.